Economic

Sri Lanka inches away from crossing 600,000 tourist arrival mark

Nov. second week arrivals up by 19% from Nov. first week

Russia, India and UK top three tourist source markets

- Details

2022 සැප්තැම්බර් මස වන විට පෙර මස දක්නට ලැබු ඩොලර් බිලියන 1.48 ක ආනයනයට වඩා අඩු ආනයනයක් දක්නට ලැබුණු අතර ඒ ඇමරිකානු ඩොලර් බිලියන 1.28 ක් බවට අනාවරණය විය. කෙසේ වෙතත් 2022 ජූනි මාසයේ මෙසේ දැක්වුණු ඩොලර් බිලියන 1.22 අගය මෙම වසරේ මේතාක් වාර්තා වූ අඩුම අගය වන අතර විදේශ විනිමය අර්බුදය හමුවේ එම අගය තවදුරටත් පහත වැටීමට ඉඩක් ඇති බවට එය තහවුරු කිරීමකි.

- Details

After peaking at 69.8% in Sept. headline inflation decelerated to 66% in Oct.

“Recent rise in interest rates should turn around because inflation has turned around”– CB Governor Dr. Nandalal Weerasinghe

Says actions will be taken to ease banking sector rupee liquidity in next couple of weeks

- Details

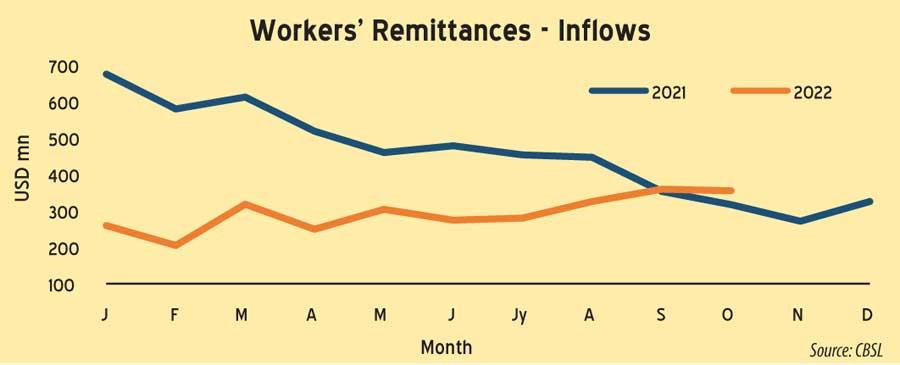

SL receives US$ 355mn from expatriate workers in Oct, up 12% YoY

September remittance income marked an end to a year-long declining trend

However, cumulative remittance income for first 10 months down by over 40% YoY

- Details

2022 වර්ෂයේ දෙවැනි භාගයේ මේ දක්වා කාල සීමාව තුළ ශ්රී ලංකා ආර්ථිකය ස්ථාවර වීමේ ලක්ෂණ පෙන්නුම් කරන බව ශ්රී ලංකා මහ බැංකුව පවසයි. වසරේ මුල් භාගයේ දී දැඩි බාධක වලට සහ අවිනිශ්චිතතාවන්ට මුහුණ දෙමින් ආර්ථිකය මැදි කාලීනව ස්ථාවර හා තිරසාර වර්ධන මාවතක් කරා මෙහෙය වීමේ අරමුණින් සිදු කළ බහුවිධාකාරී ප්රතිපත්තිමය මැදිහත් වීම ඊට හේතුවයි.

- Details

The Central Bank Governor Dr. Nandalal Weerasinghe yesterday assured to address the rise in short-term interest rates which was partly triggered by liquidity shortage in the market.

- Details

ශ්රී ලංකා මහ බැංකුවේ (CBSL) 2021 වාර්ෂික වාර්තාවට අනුව 2020 හි රු. බිලියන 285.4 ක ආයෝජන ආදායමට සාපේක්ෂව ඉකුත් වසරෙදී මුළු ආයෝජන ආදායම ලෙස රු. බිලියන 342.2 ක ආදායමක් උපයමින් සේවක අර්ථසාධක අරමුදල (EPF) 2021 අවසානය වන විට ට්රිලියන 3 ක අගයක් ඉක්මවා ගොස් ඇති බවට ශ්රී ලංකා මහ බැංකුව වාර්තා කරයි.

- Details

The construction work of the $ 789 million West Terminal began yesterday, aimed at boosting Colombo Port’s capacity by a further 3 million TEUs once completed within 24 months.

- Details

ඉදිරි අයවැයෙන් ද යළි බදු වැඩි විය හැකි බවට බොයෝ පාර්ශව මත පල කරනවා. ඵම මත සනාත කරමින් ඵතනෝල් ආනයන බද්ද යළි ඉහල දැමීමට තීරණය කර ඇති බවයි මුදල් රාජ්ය අමාතය රංජිත් සියඹලාපිටිය පැවසුවේ.

- Details

Releasing “Recent Economic Developments: Highlights of 2022 and Prospects for 2023” publication ahead of 2023 Budget next week CBSL suggests swift policy actions as circumstances evolve key due to crisis’ unprecedented scale and global uncertainties on several fronts

Expects economy to transition onto path to recovery from latter part of 2023

Insists recovery will hinge on policymakers’ unwavering commitment to implementing policy reforms in a timely, holistic, and efficacious manner while ensuring such commitment remains unhampered by political and election cycles

Reiterates it is imperative to prevent any oscillations of national policies in crucial period ahead

The Central Bank yesterday declared that the crisis-hit economy has shown signs of stability but warned that expected near term recovery is fraught with many challenges.

The CBSL assessment via the release of “Recent Economic Developments: Highlights of 2022 and Prospects for 2023” yesterday comes days ahead of the 2023 Budget presentation in Parliament next Monday (14 November).

The publication lists a host of initiatives taken to ensure stability in the economy following what CBSL described as “extreme headwinds and heightened uncertainties during the first half of 2022.”

It said the economy has “shown signs of stability in the second half of the year thus far, helped by the myriad of multifaceted policy interventions undertaken to steer the economy to transition towards a path of stable and sustainable growth over the medium term.”

However, CBSL said the expected near-term recovery of the economy is “fraught with many challenges” due to the unprecedented scale of the crisis that the economy is facing and uncertainties on several fronts which may require swift policy actions as circumstances evolve.

It said in the midst of significant economic challenges on the domestic front, the economy will also have to grapple with global uncertainties emanating from monetary policy tightening measures adopted by major central banks in response to surging inflation, the spill over effects of geopolitical tensions and thereby a looming global recession, which will make the external environment less conducive for economic recovery.

“Considering the progress that has been made thus far in relation to the IMF-EFF program and debt restructuring negotiations, and the reforms that have already been undertaken and those that are to be implemented in the period ahead, the economy is expected to transition onto the path to recovery from the latter part of 2023,” CBSL said.

Nevertheless, it emphasised that “this will hinge on policymakers’ unwavering commitment to implementing policy reforms in a timely, holistic, and efficacious manner while ensuring that such commitment remains unhampered by political and election cycles.”

“This is imperative to prevent any oscillations of national policies in the crucial period ahead in order to strengthen the economy’s resilience to external shocks, thereby ensuring its unwavering progress over the medium term,” the CBSL said.

Following are excerpts from the CBSL publication “Recent Economic Developments: Highlights of 2022 and Prospects for 2023.”

Although the economy was on a recovery path subsequent to the abating of the COVID-19 pandemic, its progress was muted by the culmination of the entrenched twin deficits in the Government budget and external current account.

Hence, the growth momentum observed towards the end of 2021 dissipated rapidly and the real economy fell into a contraction during the first half of 2022, driven by the spill over effects of the unprecedented economic crisis felt across several sectors, owing to fuel shortages, power outages, widespread scarcity of key imported raw materials and other essentials, and the soaring cost of production, among other factors.

The steady rise in inflation to historically high levels since the beginning of the year has hollowed out household purchasing power. This anomalous rise in inflation stemmed from domestic and global supply side disruptions, the undertaking of long overdue adjustments in administrative prices, the sharp depreciation of the Sri Lanka rupee against the USD, and the release of pent-up demand pressures emanating from the lagged impact of monetary accommodation in the recent past. Moreover, the expansionary fiscal policy with the low tax regime introduced in late 2019 fuelled inflation, not only by directly enhancing aggregate demand but also by necessitating monetary financing to bridge the expanding budget deficit amidst the lack of access to international capital markets following the rating downgrades. The monetary tightening efforts, which commenced in August 2021, accelerated thus far in 2022 to avoid possible de-anchoring of inflationary expectations and arrest lingering demand driven pressures.

Supported by these measures and the easing of supply side pressures, inflation commenced moderating along the envisaged disinflation path in October 2022. Meanwhile, the passthrough of monetary tightening measures coupled with persistently tight money market liquidity conditions led to sharp upward adjustments in market interest rates resulting in a substantial decline in private sector credit. Nevertheless, net credit to the Government by the banking system expanded notably amidst low Government revenue and limited access to foreign financing sources.

The growth of broad money supply (M2b), once adjusted for the impact of the depreciation of the rupee, has registered a deceleration from its peak in April 2022 driven mainly by the contraction in private sector credit and the decline in net foreign assets of the banking system. During the year, servicing of external debt became increasingly challenging, given the lack of access to international markets due to consecutive sovereign downgrades and the bunching of large foreign debt service payments amidst lacklustre foreign exchange inflows.

With due consideration to these challenging circumstances, the Government announced a standstill on external debt servicing on account of bilateral and commercial loans for an interim period commencing from 12 April 2022.

In the period thereafter, with the intention of helping the economy to transit to a stable and more sustainable footing, the Government embarked on a reform program through the introduction of a slew of measures to increase both tax and non-tax revenue, while continuing its drive to further rationalise expenditure through the curtailment of non-urgent capital expenditure and recurrent expenditure.

Further the Government opted to seek financial assistance from the IMF by way of an EFF arrangement. However, the overstretched fiscal position, which is already weighed down by soaring levels of debt, offered little fiscal leeway to undertake measures that could catalyse the economic recovery process. The external sector also continued to grapple with heightened challenges amidst the dearth of liquidity in the domestic foreign exchange market.

Despite the subduing of import demand and the announcement of the debt standstill, modest inflows to the current and financial accounts were insufficient to tame pressures on the exchange rate.

The external current account deficit widened in the first half of 2022, compared to the same period in 2021. The trade deficit narrowed due to the moderation in imports driven mainly by import control measures, lack of availability of foreign exchange in the market, depreciation of the exchange rate, tighter monetary conditions and the robust export performance.

Tourism earnings recorded some turnaround, while workers’ remittances remained subdued despite recording some revival in recent months. The heightened pressures on the exchange rate necessitated a measured adjustment, which was allowed on 7 March 2022. However, the sparse liquidity conditions in the domestic foreign exchange market and adverse market perceptions caused a sharper than expected depreciation of the exchange rate.

With a view to curtailing excessive and speculative volatilities in the intraday exchange rate, the Central Bank commenced providing guidance to the market by announcing a middle rate and a variation margin of the interbank weighted average spot exchange rate from 13 May 2022. This enabled restoring stability in the exchange rate to a greater extent and minimising the gap between official and grey market exchange rates.

The engagement with the IMF on a macroeconomic adjustment program progressed on many fronts, with a staff level agreement for an EFF being reached in early September 2022.

- Details

2023 වර්ෂය සදහා ඉදිරිපත් කර තිබෙන අයවැය තුළින් උද්දමනයට දැඩිව මුහුණදී සිටින ජනතාව ආරක්ෂා කරගැනීමට වැඩි අවධානයක් ලබා දී ඇති බව මහබැංකු අධිපති ආචාර්ය නන්දලාල් වීරසිංහ පවසනවා.

- Details

In a welcome move, President Ranil Wickremesinghe yesterday via his 2023 Budget speech called for due recognition of and support for entrepreneurs.

- Details

Nine-month gross income up 62.91% to Rs. 195.6 b and 89.58% to Rs. 76 b in Q3

Impairment provisioning nearly triples to Rs. 52.3 b for nine months: Rs. 34.3 b increase over first nine months of 2021 mainly on account of Government securities

Loan book grows by Rs. 148 b, deposits by Rs. 381 b over nine months, primarily helped by currency depreciation

Total assets up 20.51% to Rs. 2.39 t

- Details

Air France on Friday returned to Sri Lanka as part of resumption of its thrice weekly flights from Paris with the inaugural aircraft receiving traditional welcome.

- Details

Page 64 of 247