Economic

The Government yesterday said it was exploring different avenues to generate foreign exchange, whilst hoping that the gradual resumption in tourism and worker remittances will help avert a possible economic crash.

- Details

The $ 15 billion hotel industry is urging the Government to give it due recognition and support to ensure that the socio-economically-critical tourism sector is revitalised sooner than later amidst multiple crises.

- Details

The Central Bank announced yesterday that policy rates will be kept unchanged following the Monetary Board review on Wednesday.

- Details

Central Bank Governor Nivard Cabraal last week expressed confidence in measures announced in the short term roadmap in October to boost forex reserves and is expected to make public the progress shortly.

- Details

Higher inflation is generally credit negative for sovereigns, but presents particular risks for emerging markets (EMs), as they often face higher and more volatile inflation than developed markets (DMs), and are exposed to greater currency instability, says Fitch Ratings.

- Details

The Government yesterday unveiled the country’s biggest real-estate push with plans to attract over $ 6 billion local and foreign investments to promote the post-COVID growth trajectory of Sri Lanka.

- Details

Net foreign selling too nears Rs. 50 b mark; likely to surpass record outflow of Rs. 51 b last year

- Details

The Colombo stock market yesterday delivered a strong finish for a bullish week, with both indices up by over 1% and a high turnover of Rs. 9 billion.

- Details

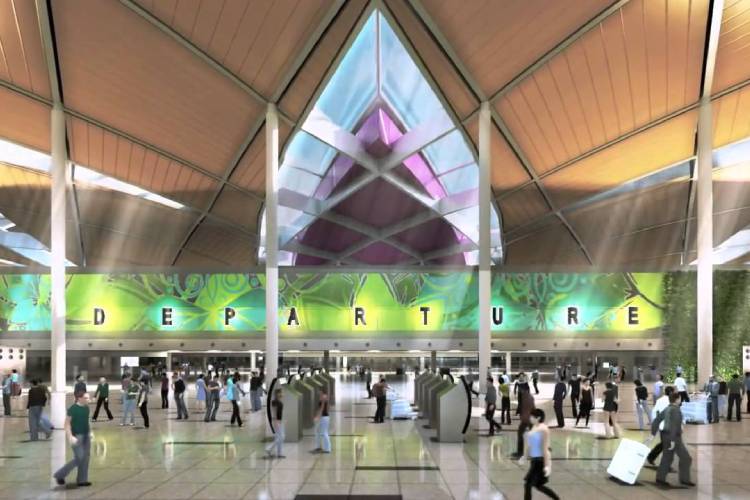

Japan-funded BIA expansion is the largest development carried by the Govt.

Aircraft parking slots increased from 26 to 49

Passenger handling capacity to increase to 15 m per year

Check-in counters increased from 53 to 127

Departure emigration counters increased from 21 to 53, while arrival immigration counters increased from 27 to 83

Aviation State Minister D.V. Chanaka says this is a significant turning point in the history of SL’s aviation industry

Full expansion project expected to be completed in 2023

Expect more world-renowned airlines to operate to Colombo post-pandemic

- Details

Tourist arrivals to Sri Lanka have exceeded 100,000 since the reopening of borders on 21 January.

- Details

President Gotabaya Rajapaksa yesterday commended exporters for not only recovering to pre-pandemic levels, but for reaching record highs, insisting that they have a key role in leading the economy towards prosperity in the post-COVID era.

- Details

People’s Bank yesterday announced the results for its nine months period ended 30 September 2021, reporting asset and deposit growth of Rs. 349.7 billion and Rs. 276.6 billion, respectively – a record high, growing by 15.7% and 15.1% during the said period.

- Details

MAS Intimates, the largest division of MAS Holdings, received three top accolades at the Sri Lanka Presidential Export Awards, including the highly coveted Exporter of the Year Award for 2020/2021.

- Details

The Central Bank Governor Ajith Nivard Cabraal yesterday expressed confidence that the economic crisis would ease by January.

- Details

Say existing safeguards are adequate against any impact from new Omicron COVID variant

Industry was anticipating 400,000 tourists with $ 600 m forex earnings until end-April 2022

Opine country cannot afford another lockdown and border closure

Industry stakeholders can work well within bio-bubble concept

- Details

Marking a milestone in the aviation industry, Prime Minister Mahinda Rajapaksa yesterday declared open the new aircraft apron of the Bandaranaike International Airport (BIA) in Katunayake. The new aircraft apron is part of the biggest, and long-overdue, development project of the multi-level second terminal of the BIA. The new aircraft apron adds 23 more slots to the existing 26, thereby increasing the total parking facility to 49. This expansion project is funded by Japan with an investment of Rs. 107 billion, making it the largest development project carried out by the Government.

- Details

Bank of Ceylon (BOC) has raised Rs. 5 billion via a private placement of Basel III Compliant, Rated, Unlisted, Unsecured, Subordinated, Redeemable Debenture issue with Non-Viability Write Down features.

- Details

Page 108 of 247