Economic

The merchandise export sector has begun 2021 on a negative note overall though some products saw growth year-on-year whilst services have got off to a positive start, latest data released by the Export Development Board (EDB) showed yesterday.

- Details

Reuters: Shares snapped a four-day losing streak yesterday, helped by gains in industrial and financial stocks.

- Details

Reversal of global commodity prices will cause a multipronged impact on Sri Lanka’s economy, exerting currency pressures due to a higher import bill, stressing finances of utility companies and have cascading effects on most sectors leading to price revisions and inflation, a report said yesterday.

- Details

The Ceylon Motor Traders Association (CMTA) yesterday voiced its concerns over the new Standard Operations Procedure (SOP) proposed by the Ministry of Industries on local assembly and local value addition of motor vehicles.

- Details

Countries across the world today are faced with severe economic hurdles and ramifications brought upon by the COVID-19 pandemic, with some key industries having come to a grinding halt.

- Details

The Government should concentrate on creating quality reserves by reducing the amount of inter-governmental financial arrangements, including swaps, and focus on structural reforms to improve Sri Lanka’s debt sustainability over the next five years, Economist and former Central Bank Governor Dr. Indrajit Coomaraswamy said recently.

- Details

Tourism Minister Prasanna Ranatunga has requested the Government to extend banking and finance sector relief granted to the tourism sector till 31 December as opposed to ending it on 31 March, as previously planned.

- Details

Sri Lanka’s first National Financial Inclusion Strategy (NFIS) was launched yesterday to make financial services more accessible, efficient, and affordable for all households and businesses in the country.

- Details

Employees in the tourism industry and Board of Investment (BOI) enterprises are likely to be vaccinated for COVID-19 by the end of March, official sources confirmed yesterday following deliberations on the matter at Monday’s Cabinet meeting.

- Details

A group of long-term equity investors yesterday expressed optimism of improved outlook for the Colombo stock market as well as the economy following a meeting with State Minister of Money, Capital Markets and Public Enterprises Reform Nivard Cabraal on Saturday.

- Details

The tourism industry yesterday sounded upbeat over signs of a good start in 2021 with arrivals topping the 5,000 mark within just a month of the country’s borders being reopened to international travellers and commercial airlines.

- Details

The Committee on Public Finance informed officials of the Central Bank of Sri Lanka (CBSL) to come up with an innovative strategic plan that works in the interest of the public, calling on CBSL not to act like State or commercial banks which are profit and ratings oriented.

- Details

මහජන බැංකු සභාපතිවරයා ලෙස සුජීව රාජපක්ෂ මහතා තමන්ටම අයත් සමාගමක් වෙනුවෙන් රුපියල් මිලියන 25ක ණය මුදලක් මහජන බැංකුවෙන් ම අනුමත කරගෙන ඇති බවට පාර්ලිමේන්තුවේදීත් ඉන් පිටතදීත් විපක්ෂය විසින් චෝදනා කරන ලද අතර; ඊට අමතරව සමගි ජන බලවේගයේ තරුණ බලවේගය නියෝජනය කරමින් මයන්ත දිසානායක මහතා ඇතුළු පිරිසක් විසින් ද පසුගිය දා මහජන බැංකු සභාපතිවරයාට එරෙහිව මහබැංකු අධිපතිවරයා වෙත පැමිණිල්ලක් ඉදිරිපත් කර තිබුණි.

- Details

The Central Bank (CB) yesterday kept policy rates steady to support economic revival and outlined plans to direct as much as 20% of the Rs. 850 billion private sector credit growth expected in 2021, to Micro, Small and Medium Enterprises (MSMEs) to boost growth.

- Details

Cabinet has cleared the West Container Terminal (WCT) of the Colombo Port to be developed as a 35-year joint venture with India’s Adani Group and its local partner John Keells Holdings PLC as well as with investment from Japan, a top official said yesterday.

- Details

Sri Lankan banks will face a deteriorating operating environment caused by the country’s weakened credit profile and COVID-19 pandemic impact, a new report by ratings agency Fitch said yesterday, warning State banks were likely to have higher risk appetites given Government reliance on them for funding.

- Details

Business leader Prabash Subasinghe has doubled his stake in Sampath Bank PLC to 10% by this week from end-December, thereby becoming the second largest shareholder.

- Details

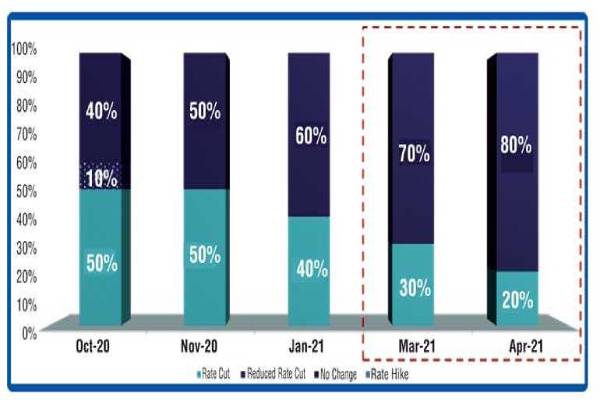

The Central Bank is likely to keep policy rates unchanged this week, First Capital Research said yesterday, though it backed slashing them further to improve slow consumer demand and sustain the secondary market at lower levels.

- Details

Page 145 of 248