Economic

ශ්රී ලංකාවේ ණය ශ්රේණිගත කිරීම යළි පහත හෙළා තිබෙනවා. ඒ, ගෝලීය ණය ශ්රේණිගත කිරීමේ ආයතනයක් වන ෆිච් රේටිං ආයතනය විසින්. ඒ අනුව ශ්රී ලංකාවේ දිගු කාලීන විදෙස් විනිමය ශ්රේණිගත කිරීම C ශ්රේණියේ සිට RD දක්වා පහත හෙළීමටයි ඔවුන් කටයුතු කර ඇත්තේ.

- Details

Outstanding balance expanded by Rs.3.9 billion as of end-March 2022

Going forward, steep increase in interest rates on credit cards could make cardholders think twice before swiping

March witnesses significant increase in new cards

- Details

Data shows banks having extended Rs.478bn in fresh credit but number hides lacklustre demand for real credit

Credit blow-up is a result of sudden rupee depreciation as banks revalued their foreign currency assets and liabilities at weaker rupee

In contrast, banks gave modest Rs.36bn and Rs.34bn in fresh credit in January and February

Swelling in private credit gives an indication of extent to which country’s public debt stock could be revalued

- Details

Two-week grace period for individuals and entities to deposit foreign notes in a bank

CB Chief describes grace period as win-win to forex hoarders and economy

Asserts yet to finalise on retaining $ 15,000 limit or reduce to $ 10,000

Says initiative to provide extra rupees for foreign remittances is unfair by taxpayers

- Details

Q1 2022 Revenue and EBITDA record YoY growth of 16% and 8% respectively

YTD Q1 2022 NPAT negative at Rs. 15.8 b impacted by forex loss of Rs. 20.2 b; normalised NPAT at Rs. 4.3 b

Total taxes paid to Govt. Rs.6 b including Rs. 2 b in direct and Rs. 3.8 b in indirect taxes

Capex Investments of

Rs. 7.5 b during quarter; OFCF reaches Rs. 6.2 b for Q1 2022

- Details

ග්රෑම් 400 ක ආනයනික කිරිපිටි පැකට්ටුවක මිල රුපියල් 1,020 ක් දක්වා ඉහළ ගොස් තිබෙනවා. නෙත් නිවුස් වාර්තාකරුවන් කළ සොයාබැලීමකදී දැක ගැනීමට හැකිවූයේ මෙම මාසයේ පස්වන දින නිෂ්පාදිත දිනය සඳහන් කිරිපිටි පැකට්ටුවල වැඩිවූ මෙම මිල ගණන් සඳහන්ව ඇති බවයි. මීට පෙර ග්රෑම් 400 ක කිරි පිටි පැකට්ටුවක් අලෙවි වුණේ රුපියල් 790 කටයි.

- Details

පුද්ගලයෙකුට සන්තකයේ තබාගත හැකි ඩොලර් ප්රමාණය අඩු කිරීමට ශ්රී ලංකා මහ බැංකුවේ අවධානය යොමුවී තිබෙනවා. මහ බැංකු අධිපති ආචාර්ය නන්නදලාල් වීරසිංහ 19 පැවති මාධ්ය හමුවකදී පැවසුවේ මේ වන විට පුද්ගලයෙකුට සන්තකයේ තබාගත හැකි ඩොලර් ප්රමාණය 15,000 සිට 10,000 දක්වා අඩු කිරීමට සාකච්ඡා ආරම්භ කර ඇති බවයි.

- Details

ASPI gains 1,030 points (13.9%) over last four sessions while more liquid S&P SL20 index gains around 409 points (17%)

- Details

The rupee yesterday appreciated to Rs. 365 level to the dollar from Rs. 377 yesterday. This is following the Central Bank issuing guidance to inter-bank rate for the first time since the exchange rate was fixed in late last year as well as since the free floatation of the currency from early March this year.

- Details

The country’s manufacturing and services sectors suffered a sharp dip in April as per the Purchasing Managers Index (PMI) compiled by the Central Bank.

- Details

The Colombo stock market achieved one of its sharpest day and weekly gains thanks to apparent improved investor sentiment on the appointment of Ranil Wickremesinghe as the Prime Minister.

- Details

Sri Lanka yesterday succumbed to an embarrassing “hard default” as the grace period for the International Sovereign Bonds (ISB) Coupon payment lapsed.

- Details

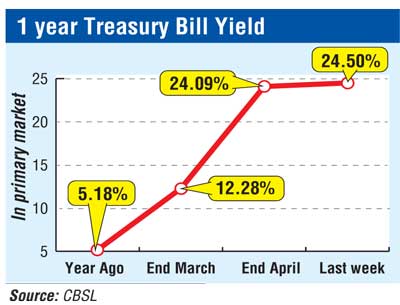

Maturing public debt is Rs. 2 trillion this year and 10% increase in interest rate fuels debt servicing cost by a further Rs. 200 b annually or Rs. 20 b per 1% hike

The sharp hike in interest rate to severely hit the Government most as analysts estimate one percentage increase translates to Rs. 20 billion per annum.

- Details

1Q sees strong NIM on the back of rising AWPLR

Solid 248% growth in exchange income stemming from sharp depreciation of rupee against dollar by 47%

Sizable 74.6% increase in net fee and commission income during the period, driven by cards and trade-related operations

Higher impairment provision on loans and investments to capture possible economic uncertainties

Marginal drop in Group PAT (4.9%) while PBT recorded a slight growth of 1.6%

Group’s PBT and PAT for Q1 2022 was Rs. 6.8 b and Rs. 4.9 b respectively

- Details

Workers’ remittances inflow has more than halved in the first quarter of this year to $ 783 million from a year ago. As per the Central Bank data, the January to March figure is down by 58% from $ 1.86 billion achieved in the first quarter of last year.

- Details

The Central Bank (CB) expects the recently introduced middle spot exchange rate to strengthen the rupee exchange rate and to ease the liquidity pressures in the domestic foreign exchange market.

- Details

ජනමතයට පටහැනිව පිහිටුවීමට අදහස් කරන අමාත්ය මණ්ඩලයට සමගි ජනබලවේගය විසින් කිසිඳු සාමාජිකයෙකු යෝජනා නොකරන බව එහි නායක විපක්ෂ නායක සජිත් ප්රේමදාස මහතා පවසනවා. ඒ, ජනාධිපතිවරයා ඔහු වෙත යොමු කළ ලිපියට පිළිතුරු ලිපියක් යොමු කරමින්.

- Details

Page 85 of 247